QuantConnect – Algorithmic Trading Platform for Quantitative Research

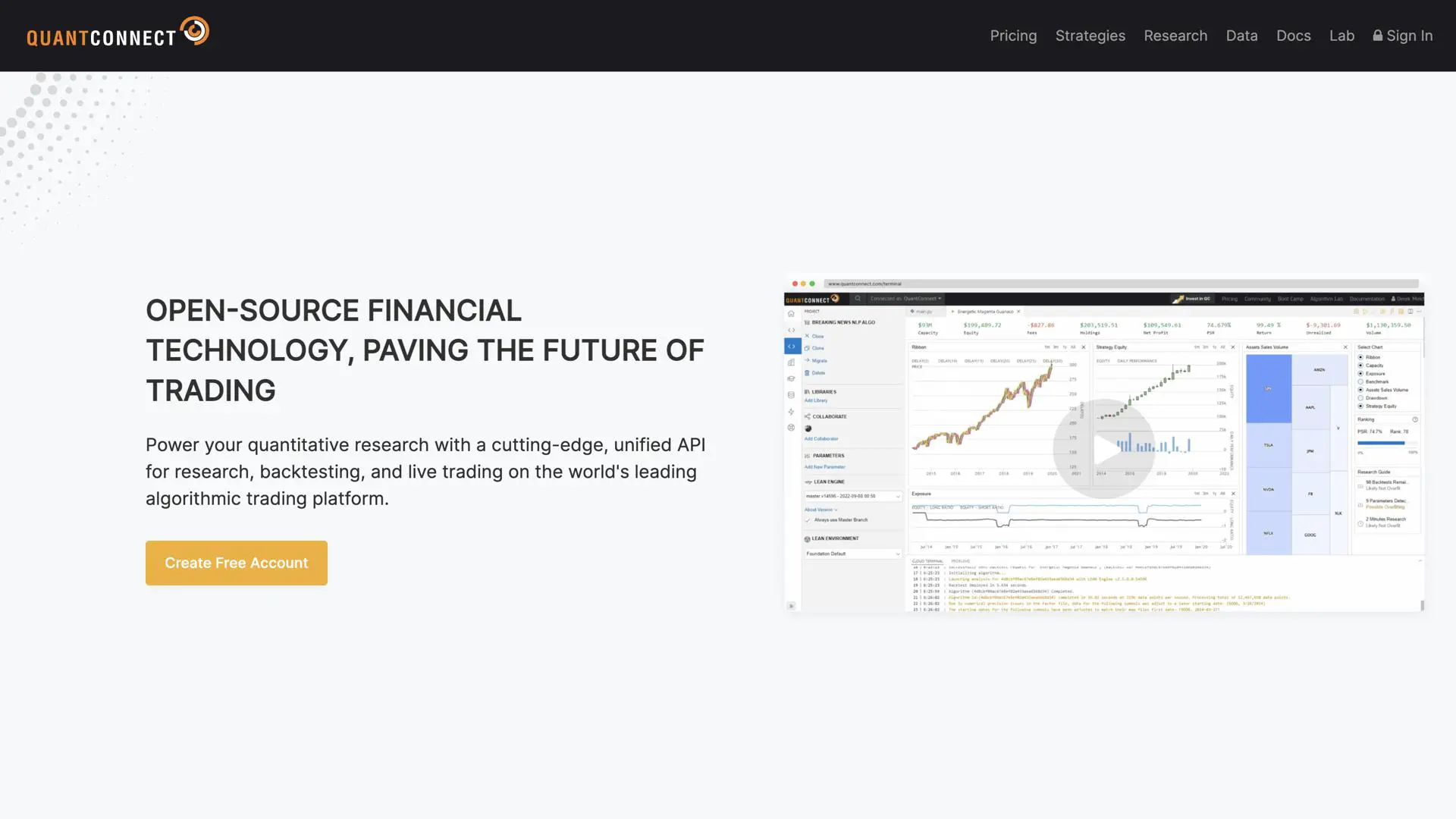

Introduction to QuantConnectQuantConnect is a comprehensive algorithmic trading platform that empowers financial professionals and researchers to design, test, and implement quantitative strategies across global markets. By providing cloud-based infrastructure and access to vast financial data, QuantConnect simplifies the development of sophisticated trading algorithms.

How QuantConnect WorksQuantConnect combines powerful backtesting tools with real-time data access, allowing users to simulate and optimize their trading strategies. The platform supports a variety of asset classes, including stocks, options, futures, and cryptocurrencies, and provides access to historical data for robust testing and research.

- Backtesting Engine: Test strategies with historical market data to assess potential performance.

- Cloud-Based Infrastructure: Run simulations and strategies in the cloud without the need for on-premises hardware.

- Multi-Asset Support: Trade a wide range of assets, including equities, options, and digital currencies.

- Data Access: Utilize extensive financial datasets for better strategy development and analysis.

QuantConnect is ideal for traders, hedge funds, and quants who want to design sophisticated trading algorithms and strategies with access to powerful backtesting tools, real-time data, and flexible infrastructure.

- Scalable Platform: Easily scale your algorithmic trading strategies to meet market demands.

- Open-Source Environment: Leverage an open-source framework for flexibility and customization.

- Integration with Brokers: Seamlessly integrate with top brokers for live trading.

- Global Market Access: Access data and trade strategies on a global scale across multiple exchanges.

QuantConnect offers a host of powerful features designed to streamline the process of algorithmic trading and quantitative research.

- Strategy Development: Build and test strategies with a variety of tools and resources.

- Real-Time Data Feed: Get access to real-time market data for live trading.

- Machine Learning Integration: Incorporate machine learning models to enhance algorithm performance.

- Live Trading Execution: Execute trades in real-time on supported brokers and platforms.

QuantConnect is tailored to meet the needs of professional traders, financial researchers, and institutions involved in quantitative finance.

- Quantitative Analysts: Design and optimize quantitative models using extensive data.

- Hedge Funds: Build scalable, automated strategies for algorithmic trading.

- Academic Researchers: Use the platform for research and the development of financial models.

- Individual Traders: Create custom strategies and backtest them before going live.

QuantConnect’s open-source framework and cloud infrastructure provide the tools necessary for deep quantitative research and real-time trading execution. By offering a unified platform for strategy development, backtesting, and live trading, QuantConnect simplifies the complexities of algorithmic trading.

ConclusionQuantConnect revolutionizes algorithmic trading by providing an accessible, powerful platform that blends research, strategy development, and live execution in a single environment. Whether you are an individual trader or a large financial institution, QuantConnect offers the tools needed to succeed in today's fast-paced financial markets.