KeeperTax AI – Smart Tax Deductions for Freelancers

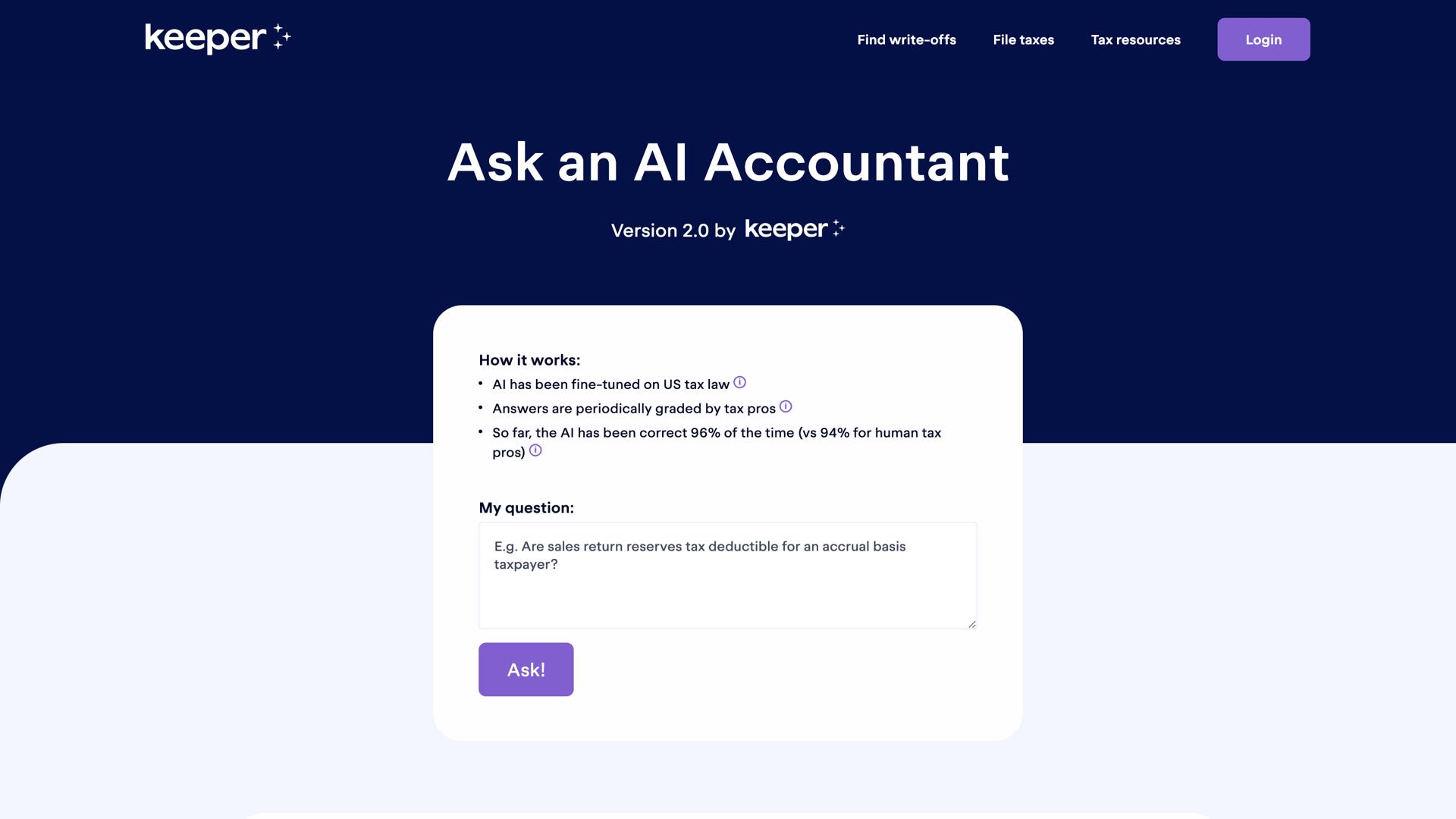

Introduction to KeeperTax AIKeeperTax AI is an advanced tool designed to help freelancers and self-employed individuals maximize their tax deductions effortlessly. By analyzing transactions, it identifies deductible expenses, reducing tax liability and simplifying financial management.

How KeeperTax AI WorksKeeperTax AI connects to bank and credit card accounts to scan for potential tax-deductible expenses. It categorizes business-related purchases and ensures users never miss a deduction.

- Automated Expense Tracking: Identifies and categorizes deductible expenses.

- Bank Integration: Connects securely to financial accounts for real-time tracking.

- Tax Filing Assistance: Helps users prepare tax reports with deductible insights.

- AI-Powered Learning: Improves accuracy by learning spending patterns.

KeeperTax AI is an essential tool for freelancers who want to save money and streamline tax preparation. It eliminates the need for manual tracking and ensures every deduction is accounted for.

- Maximized Tax Savings: Finds hidden deductions to reduce tax bills.

- Time-Saving Automation: Eliminates the need for manual expense tracking.

- Secure Data Protection: Uses encryption to safeguard financial information.

- Simple and User-Friendly: Designed for easy navigation and minimal effort.

KeeperTax AI offers intelligent automation to help freelancers and small business owners optimize their tax returns.

- AI-Driven Expense Categorization: Automatically sorts personal and business expenses.

- Real-Time Alerts: Notifies users of potential deductions throughout the year.

- Tax Report Generation: Creates IRS-ready reports for easy filing.

- Customizable Rules: Allows users to adjust categorization preferences.

KeeperTax AI is designed for self-employed individuals, independent contractors, and small business owners looking to simplify tax preparation and maximize deductions.

- Freelancers: Tracks business expenses for tax season.

- Gig Workers: Identifies mileage, supplies, and other deductible costs.

- Small Business Owners: Helps manage expenses efficiently.

- Self-Employed Professionals: Reduces tax burden with automated tracking.

By continuously monitoring transactions, KeeperTax AI ensures users take full advantage of eligible tax deductions. It minimizes tax stress and helps users stay organized year-round.

ConclusionKeeperTax AI transforms tax management for freelancers and self-employed professionals by automating deduction tracking and optimizing tax savings.